If you are living in Pakistan and often deal with international transactions, you might have encountered the challenge of transferring money from PayPal. Unfortunately, PayPal doesn’t offer its services to residents of Pakistan, leaving you with limited options. One alternative that can help you navigate this issue is Payoneer, which is widely used by freelancers, online businesses, and professionals to receive payments globally.

Step-by-Step Guide to Transfer Money From Paypal to Payoneer in Pakistan

Here’s a step-by-step guide on how to transfer money from PayPal to Payoneer in Pakistan, and we’ll also explore other alternatives to help you make informed decisions.

Step 1: Set Up a Payoneer Account

If you don’t have a Payoneer account, the first step is to sign up for one. Visit the Payoneer website and complete the registration process. You’ll need to provide some personal information, including your name, address, and a valid email address. Once your account is set up and verified, you’re ready to proceed.

Step 2: Connect Your Payoneer Account to PayPal

To transfer money from PayPal to Payoneer, you need to link your Payoneer account to PayPal. Follow these steps:

- Log in to your PayPal account.

- Navigate to “Wallet” and select “Link a card or bank.”

- Choose “Link a bank” and enter your Payoneer bank account details. You can find these details in your Payoneer account under the “Global Payment Service” section.

- PayPal will make two small deposits to your Payoneer account. This is a verification process to ensure the connection is secure.

- Once you receive the deposits in your Payoneer account, return to PayPal and confirm the verification by entering the deposit amounts.

Step 3: Confirm the Transfer

After successfully linking your PayPal and Payoneer accounts, you can now initiate the transfer. Here’s how:

- Log in to your PayPal account.

- Go to “Wallet” and select “Withdraw funds.”

- Choose “Transfer to your bank” and select your Payoneer bank account.

- Enter the amount you want to transfer and follow the prompts to complete the transaction.

Step 4: Receiving the Funds in Payoneer

The transferred funds should appear in your Payoneer account within a few business days. Once the funds are available in your Payoneer balance, you can use them for online shopping, withdraw to your local bank account, or even get a Payoneer prepaid card for easy access to your money.

Alternative Money Transfer Services in Pakistan

While Payoneer offers a viable solution for transferring funds from PayPal, it’s essential to explore other options that may better suit your specific needs:

- Wise: Wise, formerly known as TransferWise, is a popular choice for sending and receiving money globally. It offers competitive exchange rates and low fees, making it a cost-effective option for international transfers.

- SimSim: SimSim is a mobile wallet that allows for international transfers into your bank account in Pakistan. You can use it to receive funds and manage your finances conveniently.

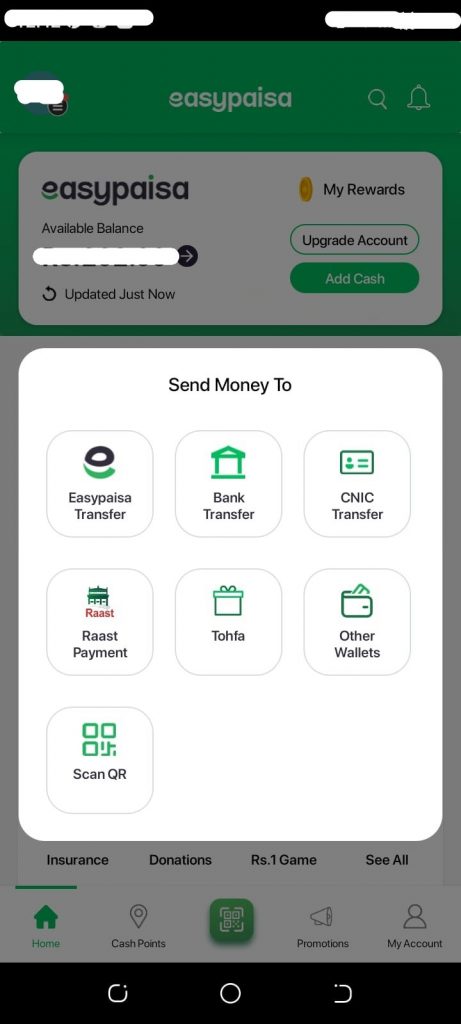

- EasyPaisa: EasyPaisa is a mobile banking service that enables you to receive, transfer, and shop with ease. It’s a practical solution for managing your finances and receiving payments.

- Mobile Wallets: Many mobile wallets in Pakistan, such as JazzCash and Easypaisa, offer the option to receive international remittances and convert them into local currency.

In conclusion, transferring money from PayPal to Payoneer in Pakistan is possible, but it requires setting up and linking both accounts. Keep in mind the verification process and transfer times. Additionally, consider alternative money transfer services based on your specific needs, including Wise, SimSim, EasyPaisa, and mobile wallets. With these options, you can efficiently manage your international transactions and receive payments with ease, even if you’re in Pakistan.