In the midst of the economic crisis in the country, loan apps seem to offer huge relief? One can apply for a loan through these apps and get quick results. But are they too good to be true? Let’s find out.

What is a Loan App?

You must have seen ads for loan apps recently. They offer quick loans without much verification and documentation, making the process of acquiring a loan sound quite simple.

While it might seem convenient, here are some facts you should know before using these apps.

SECP License and Registration

In order to raise deposits from the public, a company is required to own a license under the law of Pakistan. SECP (Securities & Exchange Commission of Pakistan) has stated that only the registration of a company doesn’t allow it to raise deposits from the public.

Companies which operate without a license are liable to strict actions according to Section 301 of the Companies Act, 2017.

The SECP has warned the public against multi-level marketing (MLM), Ponzi and pyramid schemes, and other online schemes. These companies manipulate the public and promise high rates of return.

Another big concern is that multiple apps have been found collecting personal data and using it for unauthorized purposes, many are not registered or licensed by SECP and therefore should be avoided at any cost.

Verifying Loan Apps in Pakistan – 5 Tips

Below are 5 simple tips you can follow to keep your data and money safe while using a loan app.

1. Check the SECP Site

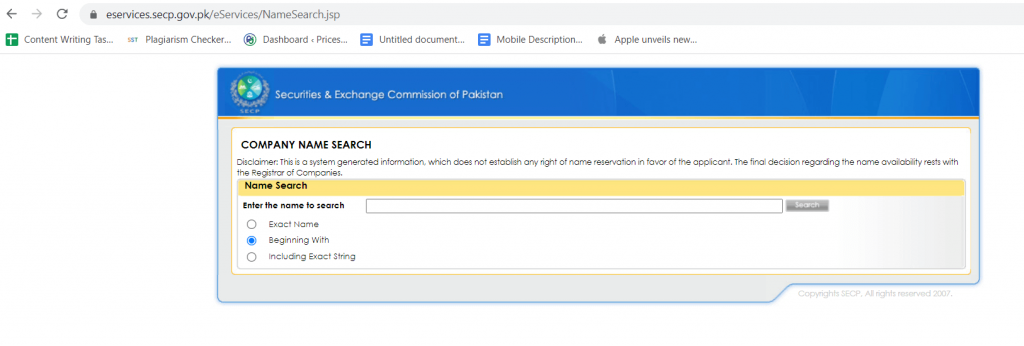

To protect yourself from scams in Pakistan, make sure to check the company of the app in question on the SECP website (the company is mentioned in the apple/google play store, below the app name).

The SECP site offers a search option where you can enter a company name. If it’s registered, you will see results otherwise it will show a message that the company was not found.

SECP Website Link: https://eservices.secp.gov.pk/eServices/NameSearch.jsp

2. Check the License

According to SECP, a company that raises public deposits is required to be licensed.

Therefore, if you are interested in an app check if the company offering the app has a license. You can email or use the SECP helpline to verify if a specific company has a license or not.

SECP helpline: 080088008

SECP email: queries@secp.gov.pk

3. Check App Permissions

When you download an app and open it, it asks for permissions, right!

And when you grant that permission like access to your contacts, locations, or gallery, the app gains access to that information which can be misused.

Therefore, make sure to check the purpose of the app and if the permission it’s asking is relevant.

4. Research the App on Google

When you are looking into any app, search the app and its company on google with terms like “scam” or scandal”.

That way you will get sufficient info about the app/company and if it was involved in any kind of fraud and data theft.

5. Use a Strong Password

A strong password is recommended in general to stay safe online. Whether you are downloading an app or making an account, using a strong password is recommended. A strong password has letters, numbers, and symbols without any order.

They are hard to memorize and crack and thus keep you safe. Make sure to use different passwords for different accounts so if one is leaked the other accounts are not compromised.

Stay Safe, Stay Vigilant!

While loan apps are a great way to offer loans to the masses, it is equally important to stay safe and vigilant while using them.

In today’s age, data theft has become a great concern and so, you should not only be careful about your money but also about your personal information.

Apps and fraud websites can steal your personal information, and debit and credit data which can lead to great damage.

Thus make sure to use SECP trusted apps, read app reviews online, and follow web security protocols in order to keep yourself safe in the unsafe online world!